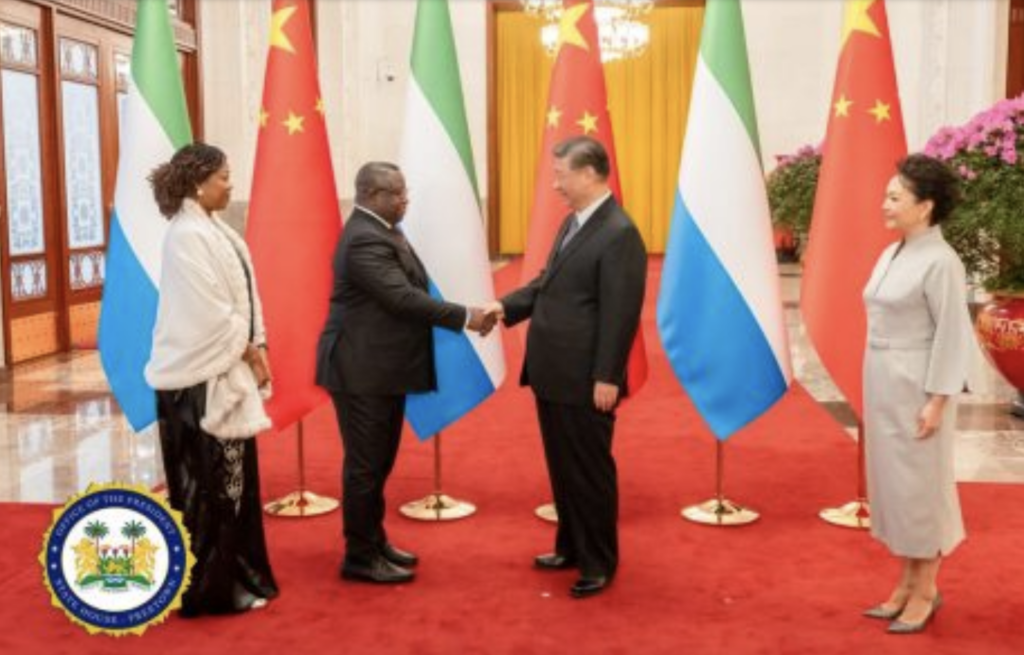

From 27 February to 2 March 2024, the President of the Republic of Sierra Leone, Julius Maada Bio, paid a state visit to China at the invitation of Chinese President Xi Jinping. The visit marked the first presidential African leadership visit to China of 2024.

Our past research shows that the frequent, African high-level visits to China are often correlated with stronger trade and investment relationships with China. But how exactly does this happen? And will this correlation remain in future, especially with concerns being expressed internationally about the state of the Chinese economy?

A closer look at President Bio’s visit last week provides some vital clues.

Sierra Leone and China established diplomatic relations on 29 July 1971. Between 2009 and 2024, Sierra Leone made six presidential visits to China, above average compared to other African countries. Furthermore, a mere 10 months ago, Sierra Leone’s Foreign Minister, David J. Francis visited Beijing. The frequency of Sierra Leone’s high-level visits clearly demonstrates that China is a priority partner for Sierra Leone for several reasons.

First, China is, by far Sierra Leone’s biggest export destination. In 2021, Sierra Leone exported US$ 341 million worth of goods to China followed by exports to Belgium, which amounted to less than half the value (US$ 161 million). This makes Sierra Leone one of the few African countries with a trade surplus with China. According to China’s General Administration of Customs (GACC), in 2023 Sierra Leone earned US$1.65 in exports for every $1 it imported from China. That said, Sierra Leone exports primarily raw materials to China, such as titanium, iron and aluminum ores followed by wood and diamonds, which leads to the second reason why China is important for the country.

China is also Sierra Leone’s biggest source for stock of Foreign Direct Investment (FDI). For instance, in 2021, China invested US$ 106 million compared to the UK’s US$ 66 million and the USA’s US$ 1 million. However, like other investors, to date, Chinese investment in Sierra Leone has focused heavily on mining of minerals, iron ore processing.

Third, China’s lending for infrastructure development as well as aid for other sectors such as livelihoods, healthcare, education, agriculture has been a key area for collaboration from Sierra Leone’s point of view. For example, the China-Sierra Leone Friendship Highway remains Sierra Leone’s sole modern expressway, playing a pivotal role in connecting the capital city of Freetown with other major urban centers. This third priority, however, has not come without challenges. For instance, in 2018 a new airport project was cancelled by the newly incoming government (still incumbent today), in particular due to concerns raised by the IMF and World Bank about Sierra Leone’s debt sustainability levels. However, new projects utilizing Chinese financing and firms have since been announced, such as a new bridge to the existing airport – the MOU for which was just signed in late 2023 – which is expected to be completed by 2027.

And last but not least, Sierra Leone has been the Chair of the African Union’s Committee of Ten (C10) on reform of the UN Security Council (UNSC) ever since its creation in 2005. Since China is one of the five permanent members of the UNSC, Sierra Leone is mandated to consult with China regularly on behalf of the African continent to strengthen China’s support for the AU position on reform of the UNSC.

So, what about China’s interest in Sierra Leone? Indeed, just over 7 years ago, in December 2016, China and Sierra Leone established a comprehensive strategic cooperative partnership (CSCP). A CSCP is considered the highest level of bilateral relations for China, a position that only 14 African countries hold with China (the others are the Republic of Congo, Democratic Republic of Congo, Ethiopia, Gabon, Guinea, Mozambique, Kenya, Namibia, Senegal, South Africa, Tanzania, Zambia and Zimbabwe). There must be something special about Sierra Leone – a country with the population size similar to that of just one Chinese city – such as Chongqing – from China’s point of view as well.

But what exactly? Two key areas stand out.

First, Sierra Leone might be a small country but it does have significant minerals. China has been making steps to diversify its sources of key mineral and energy imports to enhance resilience and energy security. For example, Sierra Leone’s two high-level visits to China in 2019 and 2023 took place during a period that China was working to reduce reliance on Australia’s iron ore exports, which is Sierra Leone’s key export to China. The 2019 visit resulted in a Joint Economic and technical Cooperation agreement and thereafter a noticeable increase in Sierra Leone’s exports to China rising from US $179 million in 2019 to US $762 million in 2022.

Second, if influencing China on African positions on global governance is important to Sierra Leone, the interest also runs the other way. Sierra Leone’s leadership within the AU on UNSC reform makes it crucial to engage with to explain Chinese positions and views as well as understand African perspectives.

These mutual historic interests aside, the key question remains as to what the future holds for the bilateral relationship, and what this also means for other African countries.

The main difference this time was President Bio’s heavy focus on diversifying investment.

Under the Bio administration, Sierra Leone has been working towards positioning Sierra Leone as a key global investment destination. Key reforms have been launched to improve Sierra Leone’s business environment including fast-track procedures for business registration, “one-stop services” for potential investors at the National Investment Board, with the emphasis on Sierra Leone’s safety and political stability.

Accordingly, President Bio presided over an investment forum during his visit, which we attended and listened to Sierra Leonean ministers making detailed presentations on bankable projects to the Chinese attendees from diverse sectors including infrastructure, mining, ICT, manufacturing and education.

Importantly, the presentations called for not only investments in infrastructure and mining, but also in agriculture and agro-processing of palm oil, rice, sugar, cocoa, oil palm, poultry and seafood, all with a view to providing new jobs in Sierra Leone as well as cutting poverty. Accordingly, the forum also called for investments in education, training and skill transfers.

That said, and as we listened to these presentations, a key gap that stood out was a demand for innovation from the African side. For example, there was no explicit link and push from Sierra Leone to climb up value chains of its existing exports to China and further develop its manufacturing capacity of those products. And while Sierra Leone has duty-free access to developed markets in North America and Europe as well as China, there was little focus on investment in agro-processing for exports to China – including of products that might require sanitary and phytosanitary (SPS) agreements, of which Sierra Leone currently has none with China.

Nevertheless, President Bio’s visit strongly suggests that China’s appetite for holistic engagement with Africa – from infrastructure, to trade, investment as well as international relations – remains strong, with no significant barrier posed by domestic economic challenges. It also indicates that many African countries, including Sierra Leone are actively trying to diversify their engagement with China. Will both sides succeed? With the ninth Forum of China-Africa Cooperation (FOCAC) fast approaching in late 2024, and with African countries working hard to recover from COVID19 and other global shocks, African leaders will need not only to maintain and diversify engagement, but also push Chinese stakeholders to try new approaches.

Rosie Wigmore is the Project Manager of the Global Trade team at Development Reimagined. She focuses on researching developments in the Africa-China trade relationship and supporting high-end African brands with entering the Chinese market.