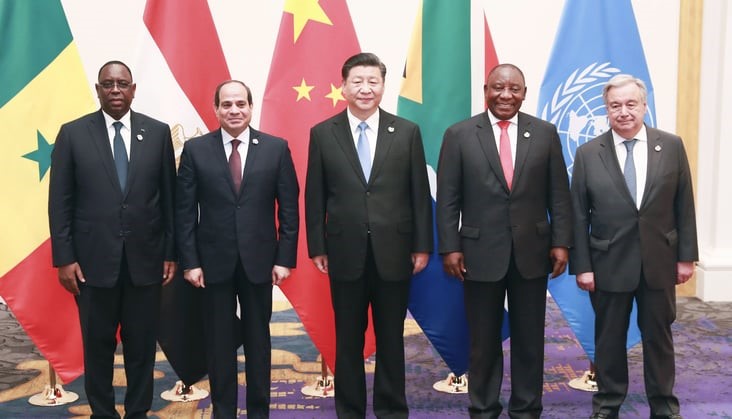

Following China’s lifting of its zero-Covid policy in January 2023, there has been a flurry of African leadership visits to China. Within eight months, China has already received seven African Presidents from Tanzania, Algeria, Eritrea, Mauritania, Burundi, Benin and Zambia and five foreign ministers from the Democratic Republic of Congo, Equatorial Guinea, Ethiopia, Sierra Leone and Zimbabwe.

It is still only September, and this is already an above average number of visits (from 2009 to 2018 visits averaged seven per year). As visits inevitably decreased during the Covid-19 pandemic to just four visits in 2022 and zero visits in 2021, this suggests that African leaders are trying to catch up since China opened its borders in January 2023 and also indicates that claims of Chinese ‘debt traps’ and US-China geopolitical rivalry have far from hindered the China-Africa relationship from advancing.

But why exactly are African leaders so keen to visit China since its borders opened?

Well, back in 2021, our firm found that African leadership visits to China resulted in increased Chinese investment and trade, and new deals and cooperation plans or the revision of existing ones. Ultimately, we found strong evidence that these visits were helping African leaders to achieve their development goals. This explains why African leaderships are high – there were 222 visits between 2009 to 2018.

Importantly, Chinese leaders also make African countries a priority. During the same period, Chinese leaders visited 40 African countries 82 times. It is also significant that despite Covid-19, Chinese leaders still visited Africa every single year from 2019 to 2023 totalling 29 visits and maintained their usual diplomatic engagements with Africa including the annual tradition of China’s foreign ministry starting his global tour in Africa, although President Xi himself only attended FOCAC 2021 virtually.

Interestingly, as is also in line with our previous research, visits are still not occurring on a reciprocal basis meaning that a visit or even several visits from top Chinese leaders to an African country did not mean that the country would necessarily return the visit, and vice versa. This suggests that African leaders are visiting China due to their own priorities and not because of China’s.

For example, China visited Egypt a total of three times between 2019 to 2023 without Egypt reciprocating making Egypt the most frequently visited African nation by Chinese leaders. On the other hand, Sierra Leone and Zambia initiated two visits to China without receiving a visit in return.

So, if there is still little alignment why are African countries engaging China and how does this differ from 2009 to 2018? We did notice some subtle changes.

Firstly, trade deals were an extremely common feature emerging from the visits between 2019 and 2023 with at least 13 SPS agreements allowing various African agricultural products to be exported to China emerging directly from leadership visits or shortly after a visit had occurred. Seven of these agreements derived from a Chinese leadership visit to the beneficial African country and six emerged from an African leadership to China. This indicates that visits initiated from both sides holds equal weight in terms of its value and potential impact.

We also noticed that leadership visits can result in significant shifts in African exports to China without specific trade deals being announced. For example, Sierra Leone’s two visits to China in 2019 and 2023 took place during Australia and China’s ongoing trade war, which led to China announcing its plan to reduce its reliance on Australia’s iron ore exports, Sierra Leone’s key export to China. The 2019 visit resulted in a Joint Economic and technical Cooperation agreement and thereafter a noticeable increase in Sierra Leone’s exports to China rising from US $179 million in 2019 to US $762 million in 2022. Clearly, Sierra Leone has benefitted from the new agreement.

Secondly, statements regarding African countries strengthening their commitment to the Belt and Road Initiative (BRI) were a feature of all African presidential visit statements which refutes the idea that the BRI is slowing down as some commentators have claimed.

Thirdly, we also noticed African leadership visits to China were becoming more strategic and resulting in FDI and deals to help fulfil long-term economic growth plans. Take Zambian President Hichilema’s recent trip to China in September 2023 that resulted in an FDI investment of US$290 million for a lithium batteries manufacturing plant in a bid to start processing Zambia’s abundant copper resources.

This is certainly great progress, but what more can be done?

Crucially, African leadership visits are still focused on bilateral agendas and a continent or regional strategy and coordination with neighbouring countries is still noticeably absent – the exceptions being Tanzania and Zambia’s joint plans to upgrade the Tazara Railway and reports about Kenya-Uganda-Rwanda coordination on an SGR extension although the latter is still unclear. Regional coordination will even become even more important with the implementation of the African Continental Free Trade Area (AfCFTA).

Furthermore, although verbal and written agreements to cooperate on the BRI were common, no specific projects financed by Chinese banks were mentioned, which contrasts with recent Chinese visits to Asia. This has led to speculation that China is “pulling back” on providing financing for African infrastructure projects. However, our analysis suggests this more a pause due to Covid-19 induced slowdowns rather than a pullback. Nevertheless, a renewed push from African leaders to secure infrastructure financing and BRI projects is crucial given the infrastructure financing needs of African countries to meet their SDGs.

With Africa facing a series of global shocks – the COVID-19 pandemic, the war in Ukraine and resulting food and energy crises, surging inflation, debt tightening, as well as the climate emergency – visits to China, a key partner for 53 African nations, will continue to grow in importance, as African countries attempt to keep their development plans on track. The continued purposefulness of these leadership visits, and the frequent outcomes, is certainly a step in the right direction and especially because it is not always guaranteed that this happens when African leaders visit other countries.

But as we have shown, more can be done. Seeing more deals like Zambia’s, to enhance value-added sectors to process natural resources will ensure these visits become even more impactful. Even better, but certainly more challenging, would be to see African countries or even regions planning these trips together to create both FDI and concessional finance for new infrastructure deals that leverage one another’s resources or manufacturing capacities – this will complement the implementation of the African Continental Free Trade Area and Africa’s ambition to become the next manufacturing hub of the world.

With the third BRI forum and the next Forum on China-Africa Cooperation (FOCAC) expected to be held in China in late 2024, now is the time to act and begin creating even more intentional strategies to ensure African leaders get the most from their relationship with China.

Rosie Wigmore is the Project Manager of the Global Trade team at Development Reimagined. She focuses on researching developments in the Africa-China trade relationship and supporting high-end African brands with entering the Chinese market.