In recent weeks, a flurry of articles appeared pointing out that Africa’s biggest bilateral trade partner, China, had significantly slowed its imports from Africa. To prevent another oversimplified doom and gloom narrative about Africa from circulating, we decided to break down the numbers to get a deeper understanding of this phenomenon – something we continuously strive to do at Development Reimagined.

After digging deeper, the first thing we discovered was, yes, there has been a significant drop in African exports to China. Although overall China-Africa trade grew by 7.4% in the first of 2023, this was driven by increased Chinese exports to Africa which grew by 16.9% between 2022-2023 whilst Africa’s exports to China dropped by 12.11%.

Some African countries recorded double-digit declines in their overall exports to China by as much as 38% in the case of Angola and 32% in Ghana. Other African countries saw large drops in specific exports, such as a 58% decrease in Angola’s crude oil and a 46% dip in the Republic of Congo’s petroleum exports to China. These countries are likely to face significant economic setbacks in the coming months given China is their main export market and close attention should be paid to the impact of this.

But the most crucial thing we discovered is that the decline in Africa’s exports to China is neither an isolated nor unique trend – it is a global phenomenon. China’s total global exports contracted by 3.16%, and total global imports experienced a higher dip of 6.72% compared to the initial half of 2022.

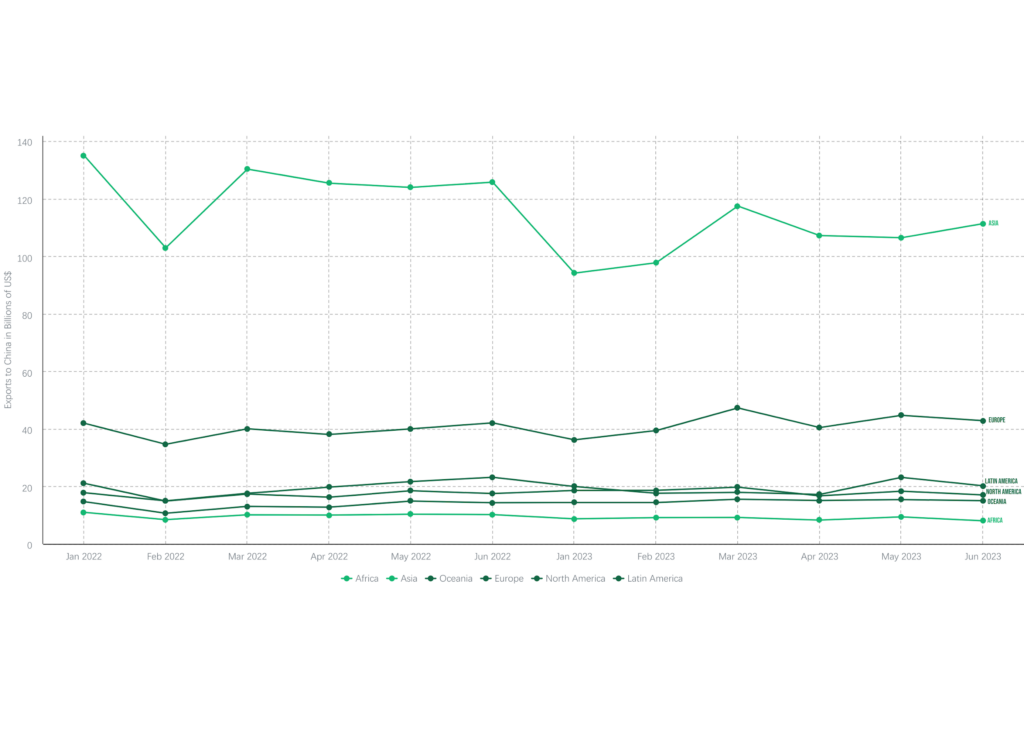

Figure 1: Trend of exports from various parts of the world to China from Jan-Jun for 2022 and 2023. (Data retrieved from GACC).

Figure 1 shows that Europe, Oceania, North America, and Latin America have all recently encountered a decrease in their exports to China. Not dissimilar to Africa, Asia’s exports to China fell by 14.67% and several countries, such as Saudi Arabia, South Korea, Japan, Thailand, Singapore, Pakistan, Iran, and Israel all faced double-digit declines. Kuwait was significantly hard hit and faced declines as high as 33%. Other regions have also been impacted, for instance the USA’s exports to China were down by 3.54% during the first half of 2023 compared to the first half of 2022 and New Zealand faced a decline of 10%.

But what is just as important to point out, however, is that within Africa not every country experienced this dip in the same way. For example, a few African countries experienced the total opposite and saw their exports of essential minerals, metals, and ores to China rise significantly. Guinea saw a massive 54.4% increase, as well as South Africa 10.5% and Gabon 11.6%, which will have a positive impact on their economies given that China is a focal export market for their resources.

Again, this is true of the rest of the world. In North America, unlike the USA, Canada achieved remarkable growth in its exports to China of 46.6%. Australia’s exports to China surged by 14.85% to reach an all-time high mainly due to strong Chinese demand for Australian iron ore and coal exports and many European countries saw their exports increase, namely Russia, Switzerland, France and The Netherlands. Thus, there is no single story in Africa nor across the world when it comes to their trade relationship with China.

Nevertheless, when the world’s second largest importer sees it its overall global imports dip by almost 7%, and in the case of Africa, almost double this amount, there are going to be real economic impacts which leads us to the question of why this happened in the first place.

According to China watchers and economic experts, China’s imports have decreased because China’s economy has recently experienced sluggish growth due to a slower than expected recovery from its

zero-Covid policy. This has led to a drop in consumption and construction, in particular due to property investment dropping by 7.9% in the first six months of 2023 compared to 2022. A dip construction explains why Africa’s exports to China dropped, as African raw materials are commonly used in China’s construction industry.

Nevertheless, predictions also show that China’s economic growth is set to rebound by 5.4% later in 2023 and 5.1% in 2024 meaning that both a consumption and construction boom is set to resume. Accordingly, dips in African exports to China will also likely rapidly recover, as will the rest of world’s.

Furthermore, nor is the current dip in African exports necessarily a negative phenomenon given Africa’s top priority is industrialising and producing value-added goods to export to China and beyond to diversify exports and reduce a reliance on exporting low value raw materials. This has even been marked out as an important area of focus by Chinese partners to Africa, as was shown in the “Initiative on Supporting Africa’s Industrialization,” which was announced at the special China-Africa Leaders’ Roundtable Dialogue at the recent BRICS summit held in South Africa. Trade in alternative sectors, such as sustainable technology, trade in services and increasing tourism from China to Africa is also receiving attention from African and Chinese leaders to create new areas of economic growth for the African continent.

Thus, although the initial half of 2023 has seen trade slumps, emerging news sources posit a noteworthy shift and highlight that the “worst of the decline in foreign demand is probably behind us.” In an already unstable global economy, the decline in Africa-China trade shouldn’t be isolated as an anomaly or cause for disproportionate concern. It is part and parcel of wider economic shifts affecting numerous nations, signalling not just a fluctuation in Africa-China relations, but an indication of broader economic challenges that are global in scope. As the African proverb goes, “smooth seas do not make skilful sailors,” we believe such shifts will bring new innovations to the African continent.

Meghna Goyal is a Data Analyst and Economist at Development Reimagined, an African-led, Woman-led International Development Consultancy.

Rugare Mukanganga is an Economist at Development Reimagined, an African-led, Woman-led International Development Consultancy.Rosie Wigmore is the Project Manager of the Global Trade team at Development Reimagined an African-led, Woman-led International Development Consultancy.