The recent visit of Benin’s President Talon to China did not hit many international headlines. However, it was particularly interesting for Africans because during the visit he secured a new agreement granting permission to export the West African nation’s fresh pineapples to China. Alongside Kenyan, South African and Tanzanian avocados, Rwandan chilis, South African citrus fruits, Tanzanian soybeans – Beninese pineapples are joining a rapidly growing list of fresh products that are finally allowed to be exported to the Chinese market.

Although this is on paper a huge success, there are still many challenges to overcome if Benin is to really capitalise on this deal – and here’s why.

First, history shows that negotiating this type of deal doesn’t necessarily result in large volumes of exports. Benin is not the first African country to export pineapples to China. Tanzania, Kenya and South Africa have all exported small volumes of preserved pineapples to China for a few years before exports fizzled out entirely.

Why? Because China already has a wealth of options to choose from. The Asia-Pacific region is the world’s largest producer of pineapples. In 2021 the Asia-Pacific produced 13 million metric tons of pineapples, which accounted for 41% of production globally. Within Asia, the two top pineapple producers, Indonesia and the Philippines, are almost China’s neighbours, which makes them an appealing import source for China.

Africa, on the other hand, produced less than half the pineapple volumes versus Asia-Pacific in 2021 with just 5.2 million metric tons of fresh pineapples. Even China itself produces pineapples, although highly seasonally and not enough to feed demand, hence China’s reliance on imports.

This has contributed to China becoming the world’s second largest pineapple importer behind the USA. China imports the majority of its pineapples from Indonesia, the Philippines and Thailand. China imports mainly fresh or dried pineapples (82%), preserved pineapples (15%) and a small amount of pineapple juice (3%) – the latter primarily from Costa Rica. Competition might become even fiercer in the Asian-Pacific region as Malaysia has also expressed its desire to become a major exporter to China and began exporting its fresh pineapples to China in 2017.

Second, the deal itself did have some limitations.

Exporting fresh products can be great for country promotion and some revenues, but African governments today are also increasingly focused on agricultural processing, manufactured products, and therefore value-added exports.

While Chinese consumers do have a preference for fresh fruit, especially compared to canned pineapples which are popular in African countries and Europe, China does produce some value-added pineapple products, such as pineapple syrups and powders, which are used in China’s infamous bubble teas and other drinks.

This should make it attractive for Chinese or other investors in Benin to not just focus on building capacity to export a consistent supply of fresh pineapples to China, but also invest in the manufacturing of these types of pineapple products for China, Europe as well as other African countries, which is in line with the African Continental Free Trade Area (AfCFTA). Diversifying Benin’s production capacity and trade partners in this way will be beneficial to Benin’s development.

So what next? How can Benin make the most of the current deal and plan for the future?

Well Benin does have one significant advantage – its pineapples are significantly cheaper than those in the Asia-Pacific to import and have been consistently so. From 2018 to 2021 the primary value of Benin’s pineapples per kilogram averaged US $1.4 compared to Indonesia’s US $14.7, Thailand’s US $2.4 and the Philippines’s US $4.7 that all also fluctuated in value. Benin can definitely utilise this when trying to capture the market.

Benin can also leverage the difference in pineapple variety. Benin mainly produces the Sugar Loaf variety and the Asia-Pacific the Smooth Cayenne, the Honey Malang and the Singapore Spanish. An advantage of the Sugar Loaf is that it has almost no acidity in comparison to Asian pineapples, which is preferred by most consumers for taste and health reasons. The Sugar Loaf can also last for a few days longer in the refrigerator than Asian varieties, which is also a great selling point.

Another factor that can weigh in Benin’s favour is that China’s trade deals and import patterns in the Asia-Pacific region have been somewhat volatile of late. For example, China banned pineapple imports from Taiwan in 2021, and Vietnamese fruit has also just been blocked from entering China. These types of shifts can create windows of opportunity for Benin, albeit not necessarily a long-term one.

Furthermore, African leaders have been encouraging China to do more to support Africa’s industrialization by financing programs of manufacturing and value-addition, and it seems China is gearing up to respond better to these demands. Thus, Benin should continue to press for Chinese investment into processing of canned pineapples, pineapple juice and pineapple syrup and powder, whether then exported to China or to other destinations.

Last but not least, to execute these strategies properly, Benin’s government and more importantly pineapple exporters also need to have a strong understanding of the Chinese market including consumer preferences, effective marketing strategies and potential sales channels – something we support with through our Africa Reimagined programme.

No doubt, the news that super sweet Beninois pineapple will soon be in China is positive. I can’t wait to try them myself! But it will also certainly take more work from all sides to make it really make a difference to Benin’s pineapple farmers – who should be the ultimate beneficiary of all these changes.

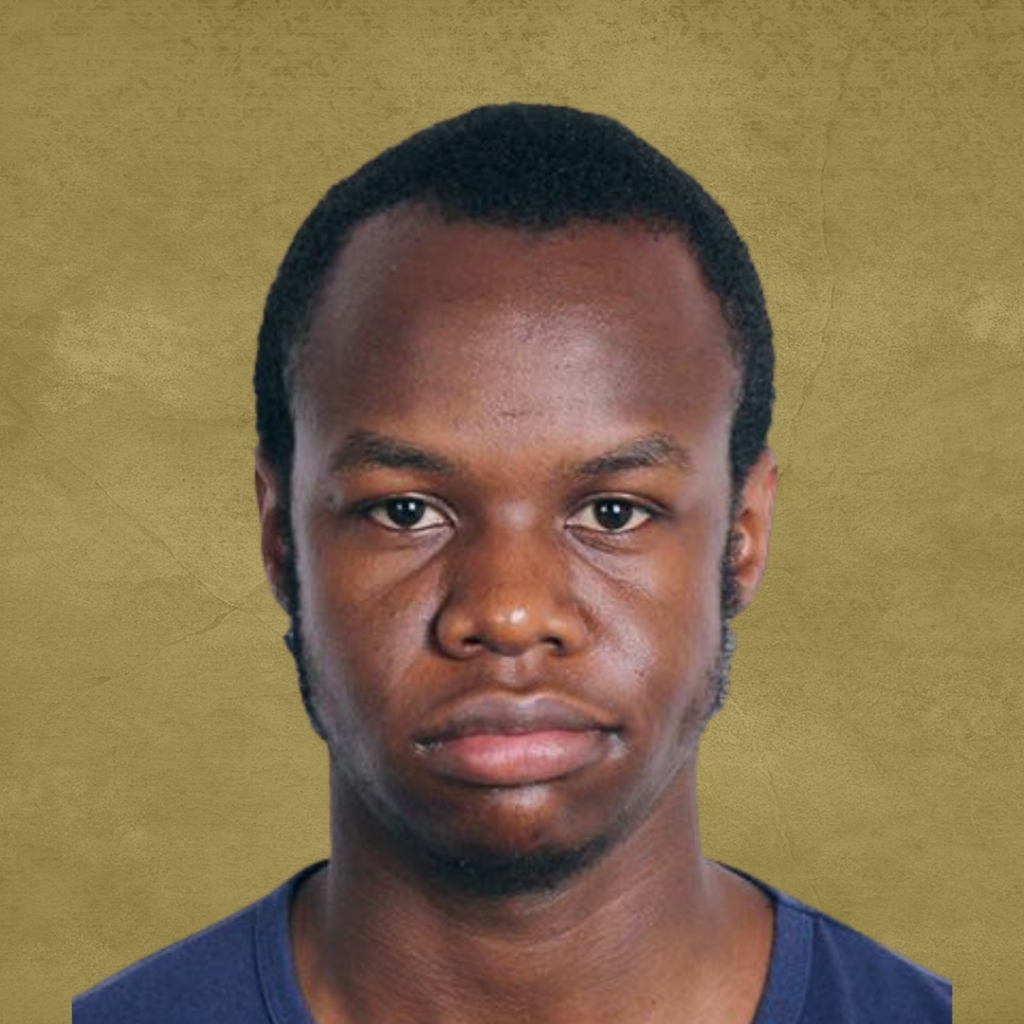

Rosie Wigmore is the Project Manager of the Global Trade team at Development Reimagined. She focuses on researching developments in the Africa-China trade relationship and supporting high-end African brands with entering the Chinese market.