Helping African Brands Enter the Chinese Market

Quick links

Menu

Menu

Founded in 2004, JD is now one China’s biggest and most trusted e-commerce platforms. It was originally founded as a website but is now accessed through its mobile app, as Chinese consumers almost solely use apps to shop online.

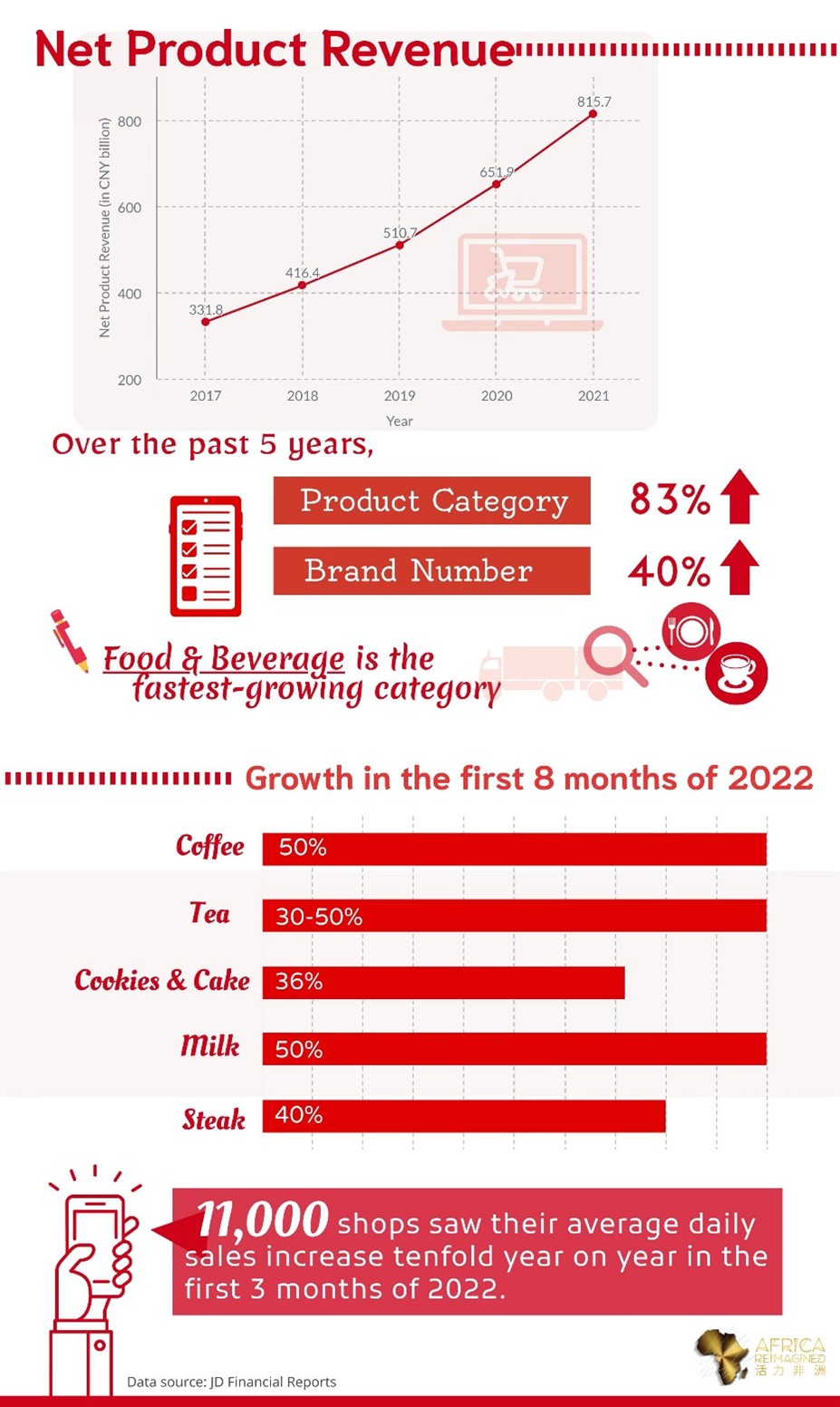

JD started out as an e-commerce platform for primarily digital devices. Since 2010, it has gradually become a comprehensive e-commerce platform by selling Food & Beverage (F&B), fashion, jewelry and accessories, health, and cosmetic products although it is still considered the most popular e-commerce platform for electronics in China. JD has also become known as a foremost platform to purchase luxury items after a wave of international luxury beauty brands opened stores on JD at the end of 2021. Over the past five years since, JD’s categories have grown by 83% and the number of brands has increased by 40%, with F&B being the fastest-growing category. Increased diversification has increased its popularity significantly. 11,000 shops saw their average daily sales increase tenfold year-on-year in the first three months of 2022.

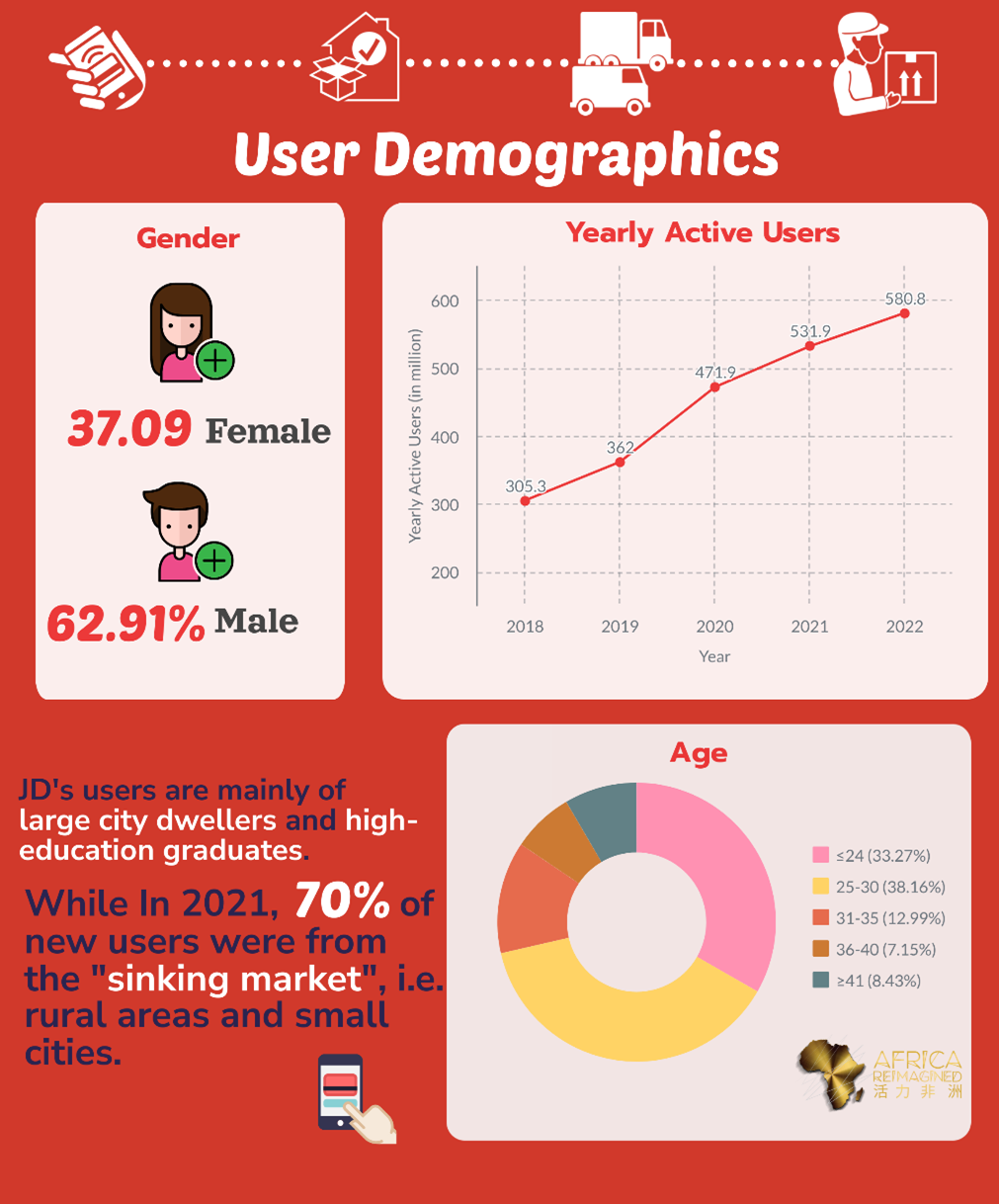

In 2021, JD had over 500 million annual active users. Due to its origins in selling digital devices, JD used to have a predominantly male user base making up more than 60% of its total users in 2019. However, due to its increasing diversification in terms of listed products and geographical focus, the number of female users has increased to more than 46% in 2021.

JD’s users are mainly constituted of high-tier city dwellers and higher education graduates. Nevertheless, JD is making successful efforts to expand its influence into the “sinking market” (rural areas and low-tier cities). Consequently, a whopping 70% of JD’s new users in 2021 were located in the “sinking market.”

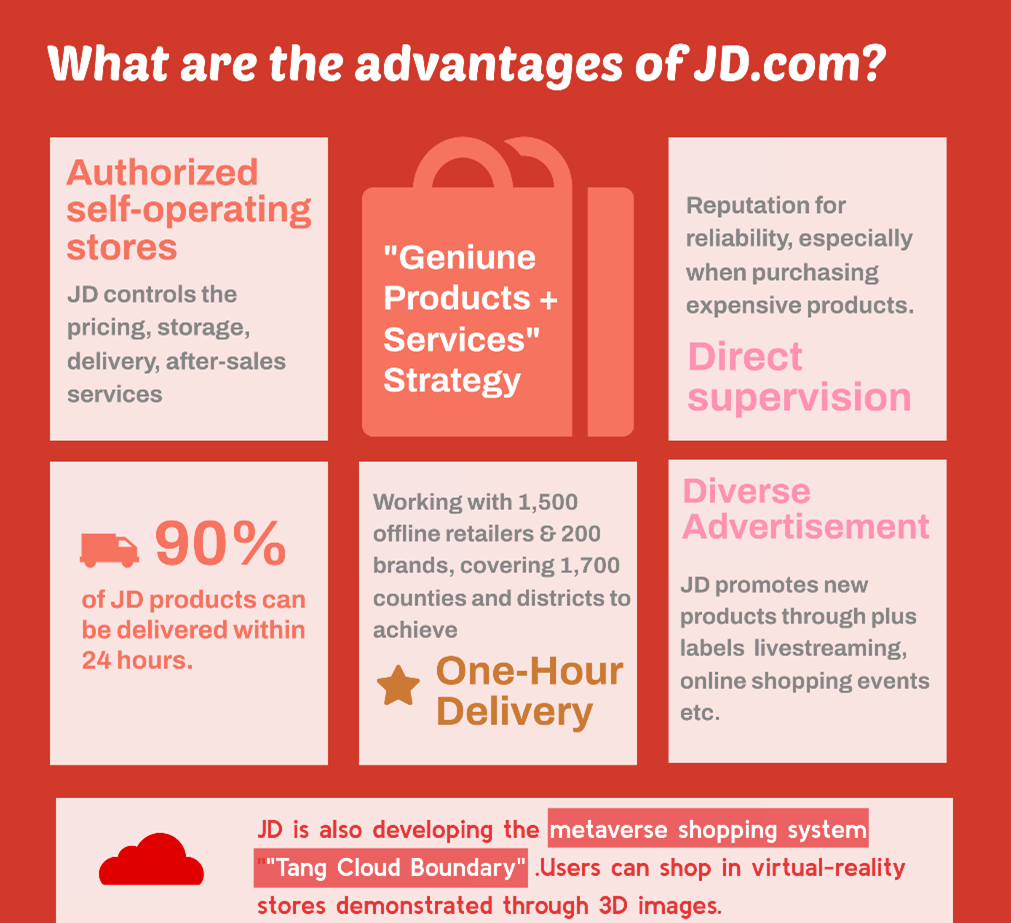

Most trusted for product quality and services: JD is considered the most reliable in terms of product quality and services. This has significantly increased its popularity amongst consumers in China and especially for electronics. This is because JD differs from the B2C and C2C models of Taobao and instead focuses on “self-operating stores.” This means that JD controls the whole selling process including pricing, storage, delivery, and after-sales service, which makes the brands and factories suppliers of JD. This gives JD more control over product quality and the after-sales service of their online purchases that is extremely appealing to customers in China. According to SPDB International, self-operating sales accounted for 94% of JD’s total revenue in 2021.

Some brands can use a self-operating tag, but they must be authorized by JD to do so which means JD is still responsible for their quality, price, and service. Thus, foreign brands selling on JD will automatically gain the trust of Chinese consumers.

Most efficient and widespread logistics service: Logistics is arguably JD’s biggest strength. This is because founded “JD Logistics” in 2007, which has since amassed 1,300 warehouses with a total storage area of 24 million m². This enables JD Logistics to provide efficient delivery services in every county in China no matter how remote. This dispersed warehouse system ensures that 90% of JD products can be sent to customers within 24 hours, which cannot be achieved by any other e-commerce platform in China.

JD’s logistics service also expands overseas, which is why JD is such a popular choice with foreign brands. JD’s logistic system has covered more than 220 countries and regions and owns 90 warehouses outside China. JD Logistics has officially announced that an international supply chain hub will open in Egypt, South Africa, and Nigeria within the next 2-3 years

Cross-border e-commerce:

One of the most convenient ways for African brands to sell on JD without even entering the Chinese market is by using JD’s cross-border e-commerce arm, JD worldwide. JD Worldwide is a platform for brands and companies that are based outside of China, as it allows merchants to ship directly from overseas or from bonded warehouses within China. Through this model, African companies can manage storage and sales directly from outside China, without the need to open a physical shops, use Chinese payment systems or register their company in China.

Innovative marketing and advertising tools: JD is also popular with foreign brands because it has numerous unique and innovative marketing and advertisement tools that help foreign brands convey their brand image effectively to the Chinese market in order to grow their customer base in China.

JD’s newest and most unique marketing and advertisement tool is JD’s take on the metaverse. JD’s “大唐灵境 (Tang Cloud Boundary)” allows users to wander in a Tang dynasty-style virtual reality world and select products ranging from beverages to cars to digital products, which are all viewed in 3D.

VR has grown in huge importance since the Covid-19 pandemic. In particular, brands have been developing replica virtual stores for customers to view and purchase items whilst in lockdown. JD has invested heavily in continuously offering new virtual ways for its customers to engage with their favourite brands to remain competitive. For example, Gucci launched a cyberspace “Gucci Town” on JD where shoppers could virtually view and purchase products as if in a real-life Gucci town. Customers could even play mini-games, interact with other customers, and purchase NFTs.

JD holds also online concerts to launch and promote products. For example, JD dozens of famous singers performed on the “JD 8 p.m. concert” that was also aired on Beijing TV to attract more customers ahead of the hugely popular e 11.11 shopping festival this year. This was followed up with a live-streamed performance featuring 30 top pop stars on 10th November where customers simultaneously watched the show and purchased discounted products.

African products are becoming popular on JD:

There are an increasing number of African brands that are choosing to sell their products on JD – and they are becoming hugely popular! However, there are still only a few types of high-end African products available on JD, leaving an opening in the market for African brands. Utilising this market opening during its early stages could bring large benefits in market shares and profits to early movers!

The most common value-added, Made in Africa products that were originally found on JD were roasted coffee and South African Wine. The South African National Wine Shop was founded on JD in 2018 and has already amassed around 100,000 followers and launched 24 different South African wine brands. The first African products that were launched on JD’s “self-operating” sales channel were Ugandan dried mangoes and Kenyan coffee in January 2019. Nowadays, a variety of African products can be found on JD including tea, skin care products (containing natural ingredients such as baobab oil or cocoa butter), roasted nuts, Rwandan chili oil, snack food, chocolate and jewellery.

JD also participated in the 4th Quality African Products Online Shopping Festival hosted by the Ministry of Commerce in May 2022 to promote African products.

For foreign FMCG and fashion brands, JD is unsurprisingly a popular choice. China market watchers predict that China’s 400 million middle-to-upper-class consumers are still projected to purchase foreign products in years come. This group of consumers show a stronger tendency to purchase products with better quality and more unique taste. Also, with the rising national confidence and broadening worldwide sight, “western” products are no longer the first choice for these consumers. In this context, African premium products can expect growing popularity.

To learn more about JD and how to sell on the JD platform, please book your free consultation here: https://www.africareimagined.com/

Helping African Brands Enter the Chinese Market

© Copyright 2024 All rights reserved

Trevor Lwere is a Research and Coordination analyst at Development Reimagined with a background in Economics and Global Affairs. His interests include geopolitics, geoeconomics and economic development. He holds a Masters’ degree in Global Affairs fro Tsinghua University and a BA Economics from the University of Notre Dame.

Sena Voncujovi is a research and policy analyst at Development Reimagined. Voncujovi specializes in global health issues, Japan-Africa relations, and China-Africa relations. He served as the Editor-in-chief of Peking University’s Africa Think Tank (PATT) during his master’s in International Relations & Politics as a Yenching Scholar. Voncujovi previously advised the Ghanaian government for the 2019 TICAD 7 Conference held in Yokohama. He is the co-founder of Jaspora, Tokyo’s largest community of African diasporan diplomats, changemakers, professionals, students, and business people.

Yixin is a Junior Research Analyst and her focus areas is on public-private partnership and entrepreneurship. She has over three years of working experience in both private and public sectors in Ethiopia. She was the China Liaison Officer for project ‘Partnership for Investment and Growth in Africa’ at International Trade Centre, where she accumulated rich experience in investment and trade promotion.

Ivory is a Kenyan lawyer with experience in policy research and analysis. She also supports the communications team through liaising with African brands, creating graphic content and other external outputs at AR. Ivory speaks English, Swahili and French

Jinyu is a dual-degree Master’s student at Sciences Po & Peking University. At Africa Reimagined, Jinyu produces research to foster better mutual understanding between African clients and Chinese consumers.

Yike Fu is a Policy Analyst and has been responsible for leading numerous areas of work, including on debt analysis in Africa and beyond, and China-Africa trade and investment logistics and analysis. She is the co-author of “African Debt Guide”, in which she challenged the narrative that Africa is in the midst of a new debt crisis by analysing data back to the 1970s and adopting new metrics to present the real story behind the data. She also developed a benchmark to compare the financial distribution of development partners such as the UK, US, Japan, France and China in Africa. Prior to her role at DR she worked at the International Finance Corporation and African Union Representational Mission to the US. She holds a Masters in International Affairs from George Washington University.

Rosie is the Project Manager of Africa Reimagined (AR) at Development Reimagined (DR) where she supports high-end African brands with entering the Chinese market by operating services such as trademark protection, Chinese market research, Chinese partnership building, and Africa to China logistical support and import/export services. Rosie has worked with DR for over two years now with proven success in helping high-end African brands navigate the Chinese market. She is extremely passionate about her work because more African brands selling in the Chinese marketplace means African countries can export MORE value-added goods, create MORE jobs and foster MORE innovation in African countries.

Leah Lynch is Deputy Director of Development Reimagined (DR), and head of the China office. Leah has over 10 years of experience in development and has lived in China for over 8 years. Leah has also travelled extensively around Asia and Africa for research. Leah supports the strategic direction of the team across China, with a mission to deliver high quality research on sustainable development and poverty reduction. Leah is also Chair of the Sustainability Forum at the British Chamber of Commerce in China, providing direction on sustainability initiatives for British and Chinese business. Leah has also consulted on various evaluations on UK aid (ICAI) and is a specialist on development cooperation from the UK and China. Leah has also consulted on various UN projects, including providing support to the UN China team during the COVID-19 Pandemic. Prior to DR, Leah was at the United Nations Development Programme (UNDP) China, supporting the UN’s portfolio on communication strategies, China’s South- South Cooperation and the Belt and Road Initiative (BRI). Before UNDP, Leah lived and worked in Kenya developing sustainable water policies for the Kenyan government.

Hannah Ryder is the Founder & CEO of Development Reimagined. A former diplomat and economist with 20 years of experience, named one of 100 most influential Africans in 2021, she is also Senior Associate for the Africa Program of the Center for Strategic International Studies (CSIS), sits on the Board of the Environmental Defence Fund, and is a member of UAE’s International Advisory Council on the New Economy. Prior to her role at DR, Ms Ryder led the United Nations Development Programme (UNDP)’s work with China to help it scale up and improve its cooperation with other developing countries, including in Africa. She has also played various advisory roles for the UN and OECD and co-authored the seminal Stern Review of the Economics of Climate Change in 2006.

We support our clients throughout the whole onboarding and sales process on Chinese e-commerce platforms including registration, international and China-mainland logistics, storage, payment transfers, and marketing & advertising strategies.

In addition to supporting our clients with onboarding onto e-commerce platforms or developing their own WeChat stores, we also have our own Africa Reimagined e-commerce stores for our clients to sell on.

Kiliselect on WeChat Stores: Africa Reimagined launched on Kiliselect, which is a foremost e-commerce store for premium African products in China and the Chinese branch of East Africa’s Kilimall. It houses brands from a range of sectors including food and beverage, skincare and homeware. Kiliselect is found on WeChat Stores, which gives the store access to 1.2 billion active WeChat users across China.

JD-Worldwide: Next year, Africa Reimagined will open the first ever flagship, pan-Africa e-commerce store for premium African brands on JD-Worldwide, the cross-border e-commerce platform of China’s largest retailer, JD.com. It will sell exclusively luxury African brands from a range of sectors including, fashion and jewellery, food and beverage, skincare. and homeware.