Helping African Brands Enter the Chinese Market

Quick links

Menu

Menu

COVID-19 has ravaged agricultural sectors across the world, with lockdowns, falling demand, and supply chain issues resulting in many producers unable to export their products. The South African wine market was thought to be no exception. But unexpectedly, Sino-Australian geopolitical tensions have not only offered a lifeline to South African wine producers, but an opportunity to enter the Chinese wine market (with its 52 million customers)!

As this recent article by Marcus Ford from Wines of South Africa highlights, as life returns to normality in China, African wine producers should pursue this opportunity to reap long-term gains. Entering the Chinese market can support the country’s economic development and provide secure job opportunities both within the wine industry and the wider supply chain.

Whilst COVID-19 disrupted trade flows across the globe and pushed industries into financial trouble, the South African wine sector has, somewhat remarkably, been spared. This is largely due to wine exports to China soaring by 50% after Beijing enforced a 212% tariff on Australian wines after escalating geopolitical tensions.

The question we’ve been tackling at Wines of South Africa, is how can South African wine producers use this opportunity to gain a firmer foothold in the Chinese wine market?

The ban on alcohol sales during South Africa’s nationwide lockdown, along with the government shutting its borders to trade, coupled with the loss of wine tourists, resulted in a domestic surplus of around 400 million bottles of wine. Such circumstances had the potential to devastate the industry which is crucial to the South African economy. In 2019, the wine industry contributed 1.1% of GDP ($3.69 billion) as well as providing 269,096 jobs (accounting for 1.6% of national employment) and $1.28 billion in household incomes. Wine tourism also contributed $1.81 million and 36,406 employment opportunities.

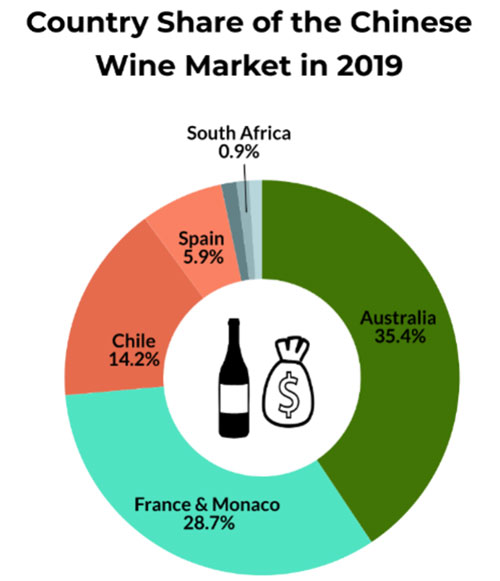

In 2019, South Africa only captured 0.9% of the Chinese wine market share, a tiny amount compared to the top three countries: Australia (35.4%), France & Monaco (28.7%), and Chile (14.2%). Comparatively, China is South Africa’s 4th top destination for wine exports accounting for 4% of its total wine exports.

Tariffs imposed on Australia resulted in a 95% decline in Australian wine exports to China in December 2020 compared to the same period in 2019, thus creating an opportunity for South African producers. On the other hand, however, this also demonstrates the risks of the market when political clashes emerge.

Understanding the boom in Chinese wine demand requires a brief history lesson. Wine was first sought after in China from 1997 following the publication of the ‘The French Wine Paradox’, which emphasized that red wine reduced the probability of heart disease, and thus the idea of wine being part of a healthy lifestyle took hold. As the Chinese hospitality sector flourished, so has the demand for wine. Wine has become increasingly associated as part of business entertainment and a banquet essential, as well as a luxury for the wealthy.

Chinese domestic wine production has also grown since the 2000s. However, the quality has not kept up with those of imported origins, with consumers beginning to understand the difference regarding wine quality.

Recently, the wine market has begun to mature, with consumers becoming more engaged in wine, especially as education programs and digital channels have made information on high-quality, international wines more widely available. According to Wine Australia, there are an estimated 52 million customers in China for imported wine, which is almost double the size compared to seven years ago.

Despite the recent increase in South African wine exports, numerous challenges to entering the Chinese market exist. Importantly, overall demand for wine in China has declined due to COVID-19, with imports down by around 30%, due to the lack of occasions for wine consumption as large gatherings and celebrations were ceased.

Other obstacles exporters must navigate include transport logistics, foreign regulations, procedures and legal requirements, alongside general cultural and language differences. As such, producers must be strategic and ensure they pick the right partners when exporting.

Only a handful of platforms exist for supporting South African wine brands entering the Chinese market. For instance, Africa Reimagined, a Beijing-based trade consultancy, assists African brands, including South African wines, in navigating the Chinese market. To support the growth of exports, Wines of South Africa provides in-depth knowledge of the Chinese market, supplemented with guidance, market research, and distribution partnerships. For example, we published a comprehensive Wine Export Guide, which provides an overview of the typical wine export procedure, alongside providing detailed methods to overcome market-entry challenges. We also work with the Cape Export Network, an online portal that matches distributors and importers with South African exporters.

To understand how South Africa can increase its exports, we must look at the methods of other top wine exporters. For instance, China has established Free Trade Agreements with import destinations such as Australia, Chile, and New Zealand, which brought duties down from 14% to zero from 2012-2019. If South Africa could establish a similar agreement on its wines it would help our producers overcome a major cost barrier and support overall export promotion.

Second, promoting the exposure of South African wines both online and offline is key. Chinese consumers use e-commerce platforms to purchase and research wines with 49% of wine consumers from China’s urban upper-middle-class purchasing wine through e-commerce. Harnessing the power of e-commerce platforms as the Chinese middle-class continues to expand can promote our products and further our sales. Additionally, increasing South African wines on Chinese supermarket shelves will elevate the reputation of our wines.

Deepening wine exportation is an effective way for China-South Africa agriculture cooperation compared to other cooperation methods. This is because South African wine producers have considerable experience in exporting their products worldwide, exporting almost 50% of all wine produced in 2018. In 2020, the UK, Germany and the Netherlands ranked as the top three export destinations, each experiencing a 23%, 4%, and 17% export growth, respectively. As the industry is already significantly developed, it does not need extensive development cooperation for it be viable but instead requires institutional support from government cooperation.

Wine is viewed as part of a healthy lifestyle and we forecast this will have a positive impact on increasing wine sales post-COVID. Indeed, we have already begun to see wine sales increasing as China’s economy and consumption are bouncing back fast. China’s GDP is forecast to grow at a minimum of 6% per year – every percentage point of growth brings new consumers which South African brands can capitalize on. We must use this time to establish a secure foothold in the market for future gains.

Expanding our wine exports will generate an array of social and economic benefits for future livelihood improvements across South Africa. Currently, South Africa has the third-highest unemployment rate in Africa, and by the end of 2020, 32.5% of the population was unemployed – a 4% increase from pre-pandemic levels. Youth unemployment is especially high, with a rate of 63% for those aged between 15-24. The pandemic resulted in a further 3 million jobs lost, mainly impacting those employed in the informal sector. High unemployment rates have therefore resulted in limited progress in poverty reduction. Indeed, whilst poverty has fallen from 71% of the population in 1996, it still encumbers 57% of the population as of 2014. Currently, the World Bank estimates that COVID will lead to 2 million more people falling into poverty (living under USD5.50 per day).

Moreover, labor conditions in the South African wine industry have remained poor despite the industry’s growth. Low wages, coupled with seasonal working contracts, have left workers vulnerable to international market volatility, with over 21,000 jobs lost in the industry by October 2020 due to the pandemic.

Considering this, developing a foothold in the growing Chinese consumer market can provide our exports long-term opportunities from increasing demand. As such, this will stimulate additional direct jobs in wine agricultural production, alongside indirect jobs, such as in logistic and transport services, to meet export demand. As South African brands become more reputable, this will likely generate spill-over effects in wine tourism, therefore providing further employment opportunities in the service sector. The provision of jobs and incomes is critical for empowering people to lift themselves out of poverty.

Further, creating a sustainable long-term footprint for wine exports can support the revitalization of the South African economy in its post-COVID recovery. Our GDP growth dropped sharply to -8% in 2020. Whilst we are forecasted to have a healthy 3% GDP growth in 2021, additional growth is an essential factor for developing our economy and driving poverty reduction, alongside enhancing our ability to meet the Sustainable Development Goals in 2030.

But we need to think long-term. Whilst in the short term the demand for wine is still recovering, the long-term payoffs of entering the market, whilst there is a gap, will bring phenomenal gains for the domestic industry back in South Africa. This is not limited to South Africa, and other wine-producing African countries should also seek to take advantage of this market opening. Put simply, this is an opportunity that African wine producers should not miss.

Marcus Ford is the Asia Market Manager at Wines of South Africa, based in Shanghai.

This article was originally published on The China-Africa Project

Helping African Brands Enter the Chinese Market

© Copyright 2024 All rights reserved

Trevor Lwere is a Research and Coordination analyst at Development Reimagined with a background in Economics and Global Affairs. His interests include geopolitics, geoeconomics and economic development. He holds a Masters’ degree in Global Affairs fro Tsinghua University and a BA Economics from the University of Notre Dame.

Sena Voncujovi is a research and policy analyst at Development Reimagined. Voncujovi specializes in global health issues, Japan-Africa relations, and China-Africa relations. He served as the Editor-in-chief of Peking University’s Africa Think Tank (PATT) during his master’s in International Relations & Politics as a Yenching Scholar. Voncujovi previously advised the Ghanaian government for the 2019 TICAD 7 Conference held in Yokohama. He is the co-founder of Jaspora, Tokyo’s largest community of African diasporan diplomats, changemakers, professionals, students, and business people.

Yixin is a Junior Research Analyst and her focus areas is on public-private partnership and entrepreneurship. She has over three years of working experience in both private and public sectors in Ethiopia. She was the China Liaison Officer for project ‘Partnership for Investment and Growth in Africa’ at International Trade Centre, where she accumulated rich experience in investment and trade promotion.

Ivory is a Kenyan lawyer with experience in policy research and analysis. She also supports the communications team through liaising with African brands, creating graphic content and other external outputs at AR. Ivory speaks English, Swahili and French

Jinyu is a dual-degree Master’s student at Sciences Po & Peking University. At Africa Reimagined, Jinyu produces research to foster better mutual understanding between African clients and Chinese consumers.

Yike Fu is a Policy Analyst and has been responsible for leading numerous areas of work, including on debt analysis in Africa and beyond, and China-Africa trade and investment logistics and analysis. She is the co-author of “African Debt Guide”, in which she challenged the narrative that Africa is in the midst of a new debt crisis by analysing data back to the 1970s and adopting new metrics to present the real story behind the data. She also developed a benchmark to compare the financial distribution of development partners such as the UK, US, Japan, France and China in Africa. Prior to her role at DR she worked at the International Finance Corporation and African Union Representational Mission to the US. She holds a Masters in International Affairs from George Washington University.

Rosie is the Project Manager of Africa Reimagined (AR) at Development Reimagined (DR) where she supports high-end African brands with entering the Chinese market by operating services such as trademark protection, Chinese market research, Chinese partnership building, and Africa to China logistical support and import/export services. Rosie has worked with DR for over two years now with proven success in helping high-end African brands navigate the Chinese market. She is extremely passionate about her work because more African brands selling in the Chinese marketplace means African countries can export MORE value-added goods, create MORE jobs and foster MORE innovation in African countries.

Leah Lynch is Deputy Director of Development Reimagined (DR), and head of the China office. Leah has over 10 years of experience in development and has lived in China for over 8 years. Leah has also travelled extensively around Asia and Africa for research. Leah supports the strategic direction of the team across China, with a mission to deliver high quality research on sustainable development and poverty reduction. Leah is also Chair of the Sustainability Forum at the British Chamber of Commerce in China, providing direction on sustainability initiatives for British and Chinese business. Leah has also consulted on various evaluations on UK aid (ICAI) and is a specialist on development cooperation from the UK and China. Leah has also consulted on various UN projects, including providing support to the UN China team during the COVID-19 Pandemic. Prior to DR, Leah was at the United Nations Development Programme (UNDP) China, supporting the UN’s portfolio on communication strategies, China’s South- South Cooperation and the Belt and Road Initiative (BRI). Before UNDP, Leah lived and worked in Kenya developing sustainable water policies for the Kenyan government.

Hannah Ryder is the Founder & CEO of Development Reimagined. A former diplomat and economist with 20 years of experience, named one of 100 most influential Africans in 2021, she is also Senior Associate for the Africa Program of the Center for Strategic International Studies (CSIS), sits on the Board of the Environmental Defence Fund, and is a member of UAE’s International Advisory Council on the New Economy. Prior to her role at DR, Ms Ryder led the United Nations Development Programme (UNDP)’s work with China to help it scale up and improve its cooperation with other developing countries, including in Africa. She has also played various advisory roles for the UN and OECD and co-authored the seminal Stern Review of the Economics of Climate Change in 2006.

We support our clients throughout the whole onboarding and sales process on Chinese e-commerce platforms including registration, international and China-mainland logistics, storage, payment transfers, and marketing & advertising strategies.

In addition to supporting our clients with onboarding onto e-commerce platforms or developing their own WeChat stores, we also have our own Africa Reimagined e-commerce stores for our clients to sell on.

Kiliselect on WeChat Stores: Africa Reimagined launched on Kiliselect, which is a foremost e-commerce store for premium African products in China and the Chinese branch of East Africa’s Kilimall. It houses brands from a range of sectors including food and beverage, skincare and homeware. Kiliselect is found on WeChat Stores, which gives the store access to 1.2 billion active WeChat users across China.

JD-Worldwide: Next year, Africa Reimagined will open the first ever flagship, pan-Africa e-commerce store for premium African brands on JD-Worldwide, the cross-border e-commerce platform of China’s largest retailer, JD.com. It will sell exclusively luxury African brands from a range of sectors including, fashion and jewellery, food and beverage, skincare. and homeware.