Helping African Brands Enter the Chinese Market

Quick links

Menu

Menu

Trade between Africa and China rose to a record high in 2022, rising by 35% from 2020 to $254 billion in 2022. However, this was mainly due to an increase in Chinese exports to the continent, which shows that China-Africa trade still has a deficit problem. This pattern also continues across G20 countries with on average just 3% of all products imported by the G20 coming from Africa in 2020.

These stark trade imbalances severely impact the capacity of African countries to create jobs, earn foreign exchange, and develop sustainably to cut poverty. As China and the Euorpean Union (EU) are Africa’s largest trade partners, this calls for a more sustainable Africa-China or Africa-EU relationship in order to help alleviate the acute trade imbalance.

But, in real terms how can African countries increase trade and subsequently support poverty reduction and sustainable development on the continent?

There are two strategies for increasing imports from Africa: increase the volume of African exports or increase the value of African exports.

Geographical Indications tackle the latter – value. Being Africa’s largest trade partners, both the Chinese government and the EU could take a leading role in supporting African countries with this.

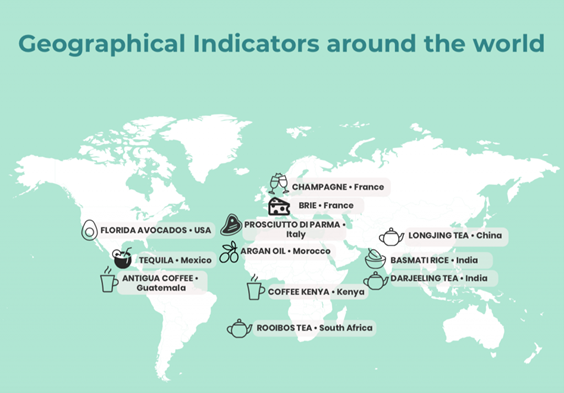

What are Geographical Indications and why are they important? Geographical Indications grant distinct rights to “the qualities, characteristics or reputation of the product essentially due to the place of origin,” according to the World Intellectual Property Organization (WIPO). In other words, GI protection allows producers to raise retail prices.

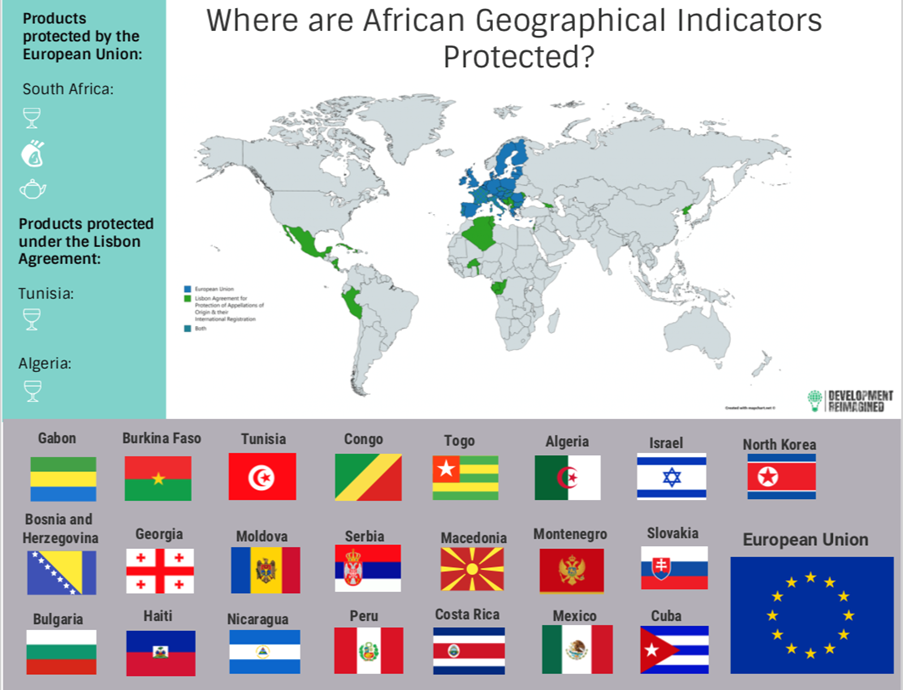

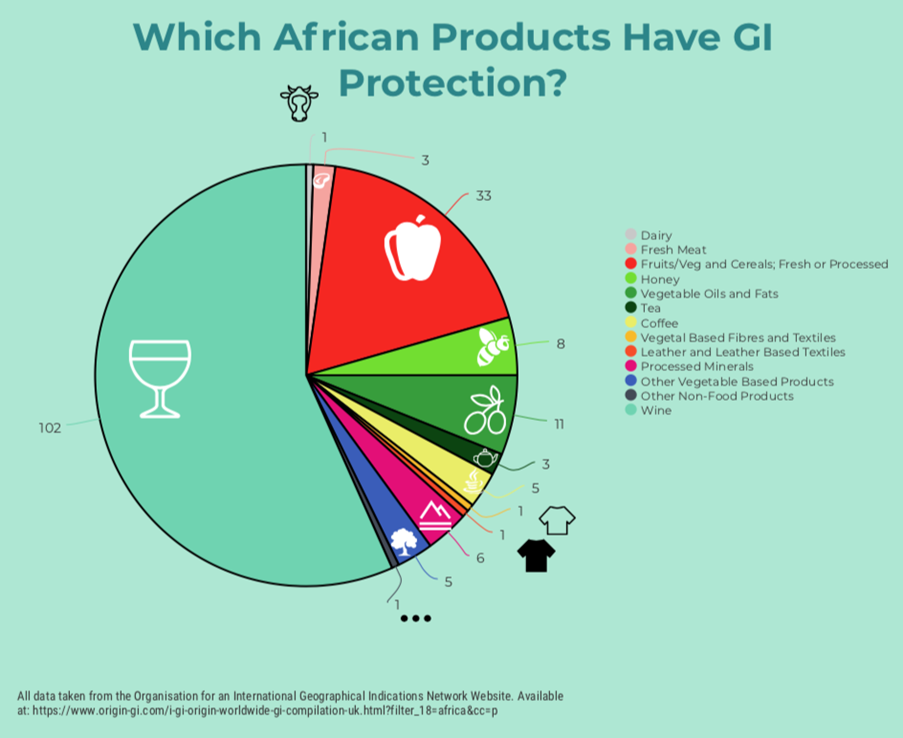

So far there are a total of 186 African Geographical Indications documented in the Origin database. Broadly, they fall into two categories: food and non-food products. African food products with GIs are very diverse. They include Guinean and Ethiopian coffees, Cameroonian honey and pepper, Mozambican goat meat, and Kenyan tea. For non-food products, wines account for majority of African GIs. Over 100 African wine brands have GIs, most of which are protected in third countries. However, all food product GIs, except for one, are only protected at the national level (the exception s South African lamb, which is protected in the EU) and no African food product GIs are protected in China.

This lack of GI protection in China and elsewhere is increasingly important because while African products are not yet GI protected in China, a few GI products are rapidly growing there such as South African wines, South African rooibos tea, and Kenyan teas. This is why China’s pledge to become Africa’s first partner to commit to developing a process to recognise Africa’s geographical indications at the 2021 Forum on China-Africa Cooperation (FOCAC) was so crucial and could have a huge impact on increasing the value of Africa’s exports to China.

Furthermore, the African Union has a strategy for promoting the adoption of GIs, particularly in the agricultural sector and the EU is also working with African regional blocs such as the East African Community to increase mutual recognition of GIs.

To support this progress, Africa Reimagined, alongside its parent company, Development Reimagined, have the following 4 recommendations for African leaders, the Chinese Government and the EU, that has the opportunity to make a substantial difference by thinking innovatively about trade:

First, we should ensure protection of African goods in China and the EU so that brands reap the benefits of their innovation. The African Union and African governments should push for GI protection in conjunction with their signing of MOUs and removing other non-tariff barriers. Specifically, the Chinese government should also promote further agreements that guarantee mutual recognition of IP and GIs in China. South African wines, Rwandan coffees, and Egyptian cottons are already for sale on Chinese e-commerce platforms Alibaba, JD, and TMall. However, most are not protected. There must be increased cooperation and legal support for these producers and products when implementing the rapidly growing China-Africa trade facilitation mechanisms through Chinese e-commerce channels.

Second, we should encourage more partnerships between Chinese investors and African brands. Through Development Reimagined and Africa Reimagined’s partnership with the Made in Africa Initiative, we encourage Chinese companies not to just distribute their products in Africa, but to actually invest and build factories there. Some are starting to build factories to serve domestic markets and the EU, where GIs and IP are well protected. More factories should also be built to directly serve the Chinese market. This is a ripe area for investment and would help countries diversify out of agriculture and commodity-based production, following China’s example.

Third, Africa Reimagined alongside its Chinese partners need to continue making the Chinese market easier to navigate for African brands. The vast majority of these brands are fairly small-scale, which is why Africa Reimagined offers a cheap and hassle-free service to help African SMEs to register their IP, trademark and copyright materials. The same services and access to information on how to register African GI’s now needs to be rapidly developed to support China’s 2021 FOCAC pledge to commit to developing a process to recognise Africa’s GIs.

And fourth, we should encourage Chinese tourism in African countries that is specifically designed to increase exposure to GI products and brands. The experience of Longjing tea attracting tourists to Hangzhou and vice versa is a perfect example of this match. Products such as South African rooibos tea have developed appeal for an increasing number of Chinese consumers through their travel to South Africa. A great deal more can be done with variation on this theme – and with growing Chinese outward tourism every year, there is every reason to harness this spending power in Africa.

Geographical Indications represent an opportunity for African countries to be proactive in protecting their already rich and unique intellectual, cultural, and territorial heritage. Protecting GIs does come with more capital investments up front in legal fees as well as education to institutionalize processes; and it does rest on a country’s capacity for international cooperation and governance. Therefore, it is important governments and forums, and market entry platforms create initiatives that enable this.

In the long term, adding value with GIs diversifies risk away from commodity prices, and instead builds a platform for sustainable growth that will lead Africa into the future.

Helping African Brands Enter the Chinese Market

© Copyright 2024 All rights reserved

Trevor Lwere is a Research and Coordination analyst at Development Reimagined with a background in Economics and Global Affairs. His interests include geopolitics, geoeconomics and economic development. He holds a Masters’ degree in Global Affairs fro Tsinghua University and a BA Economics from the University of Notre Dame.

Sena Voncujovi is a research and policy analyst at Development Reimagined. Voncujovi specializes in global health issues, Japan-Africa relations, and China-Africa relations. He served as the Editor-in-chief of Peking University’s Africa Think Tank (PATT) during his master’s in International Relations & Politics as a Yenching Scholar. Voncujovi previously advised the Ghanaian government for the 2019 TICAD 7 Conference held in Yokohama. He is the co-founder of Jaspora, Tokyo’s largest community of African diasporan diplomats, changemakers, professionals, students, and business people.

Yixin is a Junior Research Analyst and her focus areas is on public-private partnership and entrepreneurship. She has over three years of working experience in both private and public sectors in Ethiopia. She was the China Liaison Officer for project ‘Partnership for Investment and Growth in Africa’ at International Trade Centre, where she accumulated rich experience in investment and trade promotion.

Ivory is a Kenyan lawyer with experience in policy research and analysis. She also supports the communications team through liaising with African brands, creating graphic content and other external outputs at AR. Ivory speaks English, Swahili and French

Jinyu is a dual-degree Master’s student at Sciences Po & Peking University. At Africa Reimagined, Jinyu produces research to foster better mutual understanding between African clients and Chinese consumers.

Yike Fu is a Policy Analyst and has been responsible for leading numerous areas of work, including on debt analysis in Africa and beyond, and China-Africa trade and investment logistics and analysis. She is the co-author of “African Debt Guide”, in which she challenged the narrative that Africa is in the midst of a new debt crisis by analysing data back to the 1970s and adopting new metrics to present the real story behind the data. She also developed a benchmark to compare the financial distribution of development partners such as the UK, US, Japan, France and China in Africa. Prior to her role at DR she worked at the International Finance Corporation and African Union Representational Mission to the US. She holds a Masters in International Affairs from George Washington University.

Rosie is the Project Manager of Africa Reimagined (AR) at Development Reimagined (DR) where she supports high-end African brands with entering the Chinese market by operating services such as trademark protection, Chinese market research, Chinese partnership building, and Africa to China logistical support and import/export services. Rosie has worked with DR for over two years now with proven success in helping high-end African brands navigate the Chinese market. She is extremely passionate about her work because more African brands selling in the Chinese marketplace means African countries can export MORE value-added goods, create MORE jobs and foster MORE innovation in African countries.

Leah Lynch is Deputy Director of Development Reimagined (DR), and head of the China office. Leah has over 10 years of experience in development and has lived in China for over 8 years. Leah has also travelled extensively around Asia and Africa for research. Leah supports the strategic direction of the team across China, with a mission to deliver high quality research on sustainable development and poverty reduction. Leah is also Chair of the Sustainability Forum at the British Chamber of Commerce in China, providing direction on sustainability initiatives for British and Chinese business. Leah has also consulted on various evaluations on UK aid (ICAI) and is a specialist on development cooperation from the UK and China. Leah has also consulted on various UN projects, including providing support to the UN China team during the COVID-19 Pandemic. Prior to DR, Leah was at the United Nations Development Programme (UNDP) China, supporting the UN’s portfolio on communication strategies, China’s South- South Cooperation and the Belt and Road Initiative (BRI). Before UNDP, Leah lived and worked in Kenya developing sustainable water policies for the Kenyan government.

Hannah Ryder is the Founder & CEO of Development Reimagined. A former diplomat and economist with 20 years of experience, named one of 100 most influential Africans in 2021, she is also Senior Associate for the Africa Program of the Center for Strategic International Studies (CSIS), sits on the Board of the Environmental Defence Fund, and is a member of UAE’s International Advisory Council on the New Economy. Prior to her role at DR, Ms Ryder led the United Nations Development Programme (UNDP)’s work with China to help it scale up and improve its cooperation with other developing countries, including in Africa. She has also played various advisory roles for the UN and OECD and co-authored the seminal Stern Review of the Economics of Climate Change in 2006.

We support our clients throughout the whole onboarding and sales process on Chinese e-commerce platforms including registration, international and China-mainland logistics, storage, payment transfers, and marketing & advertising strategies.

In addition to supporting our clients with onboarding onto e-commerce platforms or developing their own WeChat stores, we also have our own Africa Reimagined e-commerce stores for our clients to sell on.

Kiliselect on WeChat Stores: Africa Reimagined launched on Kiliselect, which is a foremost e-commerce store for premium African products in China and the Chinese branch of East Africa’s Kilimall. It houses brands from a range of sectors including food and beverage, skincare and homeware. Kiliselect is found on WeChat Stores, which gives the store access to 1.2 billion active WeChat users across China.

JD-Worldwide: Next year, Africa Reimagined will open the first ever flagship, pan-Africa e-commerce store for premium African brands on JD-Worldwide, the cross-border e-commerce platform of China’s largest retailer, JD.com. It will sell exclusively luxury African brands from a range of sectors including, fashion and jewellery, food and beverage, skincare. and homeware.